The results of Polish companies under scrutiny

2023 was the first year in seven years when Polish commercial law companies experienced significant slowdown. Revenues continued to grow (by over PLN 348 billion) and total assets (+PLN 448 billion). Equity also increased, which may indicate attempts to strengthen financial stability. However, despite the expansion in the scale of operations, the financial result deteriorated. We recorded a significant decline in profitability, the largest since 2017. At InfoCredit, we analyzed the results of over 360,000 commercial law companies operating in Poland. We know (almost) everything about them.

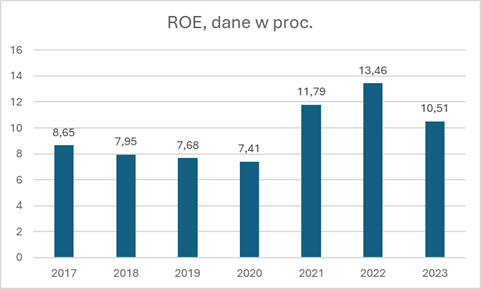

Both average gross profit and average net profit decreased compared to 2022. Profitability indicators – ROE, ROA, and ROS – also declined, indicating declining operational efficiency. Despite this, some entities invested in digitalization and sustainable development, trying to adapt to the new reality. The situation gradually improved in subsequent quarters. As a reminder, the first three months saw a 1.2% decline in GDP. The last quarter was the best (1.9% growth). Inflation was a real nightmare for entrepreneurs – at the beginning of the year, it stood at 16.6% year-on-year. It’s worth noting that the turbulence of 2023 didn’t translate into employment – employment was at its highest in 2022 and 2023 (an average of 46 people per surveyed company, compared to 39 in 2017).

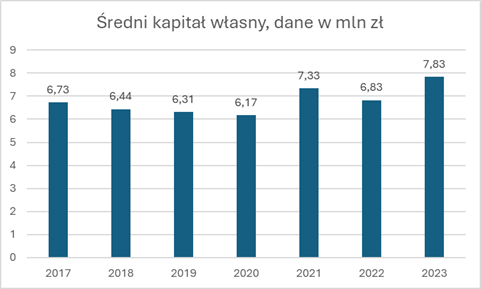

Let’s take a closer look at the detailed data for the surveyed sample of Polish companies. Average equity capital in 2023 was PLN 7.83 million, increasing by PLN 1 million year-on-year. In previous years, the best result was recorded in 2021 (PLN 7.33 million).

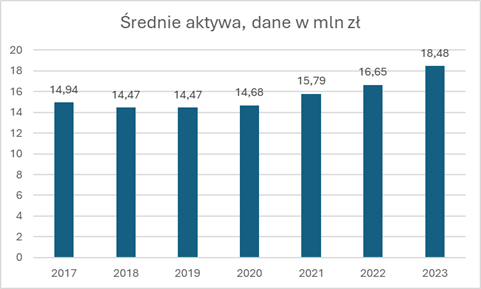

Average assets increased significantly in 2023. Since 2019, we have seen increasingly rapid growth across the sample of companies surveyed. However, average intangible assets per company remained relatively unchanged. In 2017 and 2018, they remained at PLN 0.46-0.47 million, falling to PLN 0.38 million in 2020 and recovering to PLN 0.41 million in 2023.

Is it good? It depends. Let’s move on to profitability. After some stabilization in 2017-2019, we saw significant growth in 2020-2022. And a significant reversal in 2023. Average gross profit fell from PLN 3.43 million to PLN 2.96 million. Net profit fell from PLN 2.76 million to PLN 2.38 million. It’s worth noting that in 2017, these figures were PLN 1.5 million and PLN 1.22 million, respectively.

Interestingly, between 2017 and 2022, the group of companies examined recorded significant increases in ROE, ROA, and ROS. In this regard, we didn’t experience any major turbulence in 2020, the first year we faced the effects of the pandemic and restrictions. The outbreak of a full-scale war in Ukraine did not significantly impact these indicators, despite accelerating inflation and fluctuations in the commodity market. But – in 2023, the effects of the turmoil and economic slowdown were already strongly felt.

In summary, rising costs, wage pressure, and persistent inflation have reduced businesses’ ability to generate profits despite rising revenues. SMEs were hit particularly hard, having limited opportunities to pass on costs to customers. High interest rates limited access to financing, exacerbating liquidity problems. These problems were felt not only by commercial law companies but also by sole proprietorships. As a reminder, in 2023, 372,500 sole proprietorships were suspended, compared to 347,400 the previous year. A staggering 198,200 businesses were terminated – the highest number since 2014.

What was 2024 like? Has there been a rebound? We will report on this soon once companies have fulfilled their reporting obligations. Want to know more? Interested in results in specific industries? Contact us and request an analysis: media@infocredit.pl.