We are bouncing back from the December bottom

JDG InfoCredit Index

- Throughout 2024, 375,700 sole proprietorships (SMEs) were suspended. We’ve set a record again – for the third time in a row. In 2023, we recorded 372,500 suspensions.

- The good news is that the negative trend slowed somewhat in the fourth quarter of last year. After the third quarter, we warned that suspensions could reach nearly 400,000.

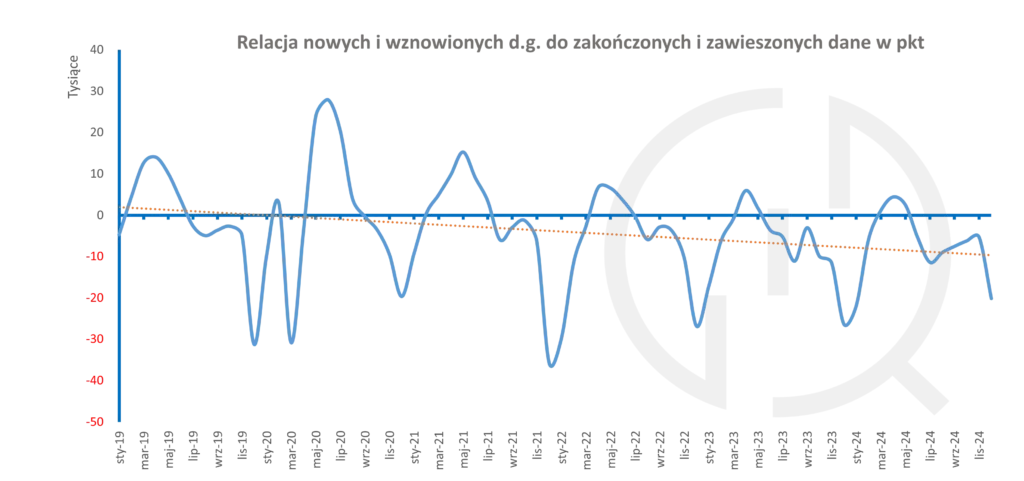

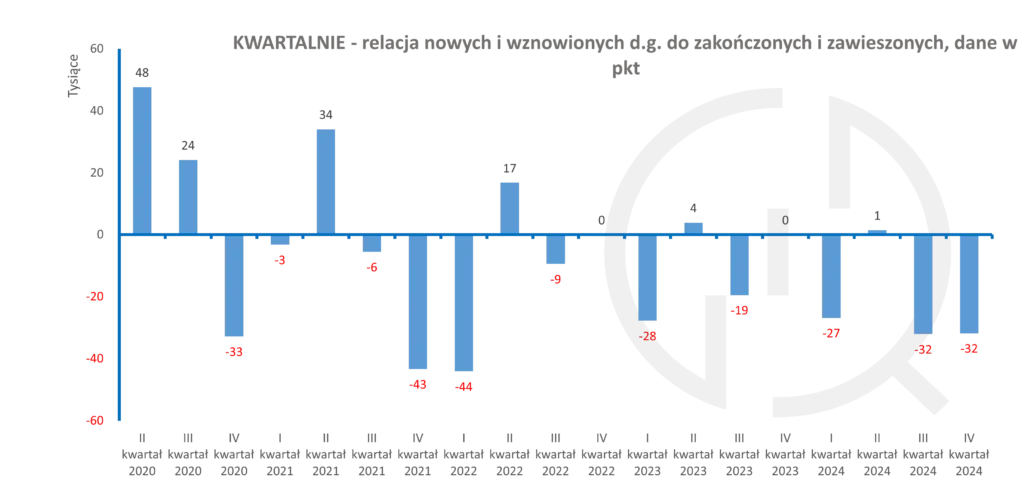

- The InfoCredit Business Activity Index has rebounded slightly quarter-on-quarter. It remains significantly negative, but significantly higher than after the fourth quarter of 2023 and 2022. The monthly IC index is similar. At the end of December, it was higher than a year ago and after 2022.

- Is this the end of the significant advantage of suspended and closed businesses over new and reopened ones, which emerged after the announcements of the Polish Deal? We’ll see. One thing is certain: relief for micro-entrepreneurs is starting to take effect. Or are we slowly becoming accustomed to the challenging conditions of running a business?

In October, we were deeply concerned. We wrote then that in the third quarter of last year alone, “103,300 business activities were suspended. That’s 6,718 more than in the same period in 2023, which was already record low.” Everything indicated that the quarterly and monthly IC Index could bottom out. This did not happen.

Why? In the fourth quarter of 2024, 93,300 businesses were suspended – 10,000 fewer than in the third quarter and 9,100 fewer than a year earlier. There were also significantly fewer closed sole proprietorships (JDGs) than a year earlier (47,100 vs. 53,300). Business resumptions increased (41,300 vs. 38,000). There were only slightly fewer new businesses than a year ago (67,400 vs. 69,900). This meant that the indices remained negative after the fourth quarter, but significantly moved away from the seasonal bottom.

December 2024 was significantly better for sole proprietors (JDG) than in recent years. 32,000 businesses were suspended, compared to 37,800 the previous year. 19,700 businesses were closed, compared to 20,400. Does this mean that the promised and implemented tax relief for micro-entrepreneurs is starting to influence their moods and decisions? Already at the end of last year, it was possible to take advantage of the ZUS (Social Insurance Institution) tax holiday. Health insurance contributions on revenues from the sale of fixed assets were abolished. As of January 1st, the minimum health insurance contribution base was reduced to 75% of the minimum wage. This translates into savings for low-income entrepreneurs. In addition, there are preferential ZUS contributions (new entrepreneurs or those who have completed their start-up tax relief can continue paying them for 24 months).

Piotr Kuczyński, Chief Analyst at DI Xelion, believes that the tax relief may have influenced entrepreneurs’ decisions at the end of the year. But that’s not all.

“For lower-income sole proprietors (SDUs), such relief is important. The outlook for our economy could also have a significant impact on everyone’s decisions. We expect a recovery this year, thanks in part to PLN 120 billion in investments from the National Operational Programme (KPO) and the Cohesion Fund. Of course, this money will flow mainly to large companies, but where small giants benefit, they can also benefit. The cost situation has stabilized. Average annual inflation of 3.6%, or even 5%, recorded in December isn’t a disaster. So, if I were to open a business, this is a good time. If I had a choice between suspending or not, I wouldn’t. The geopolitical situation remains complicated, but… we’ve been living with this for three years,” says Piotr Kuczyński.

How we calculate the InfoCredit Business Activity Index

Our business activity index shows the ratio of new and reopened businesses to closed and suspended businesses. A positive index means that more businesses were started and reopened than were suspended and closed. The higher the index value, the greater the propensity to open small businesses. A negative index value indicates a retreat from this form of economic activity. The further the index falls, the more small businesses are going out of business (permanently or temporarily). We publish the index quarterly (after each quarter) and monthly. For individual municipalities, the index value is calculated per 1,000 inhabitants.