InfoCredit Business Activity Index

Entrepreneurs vote with their feet

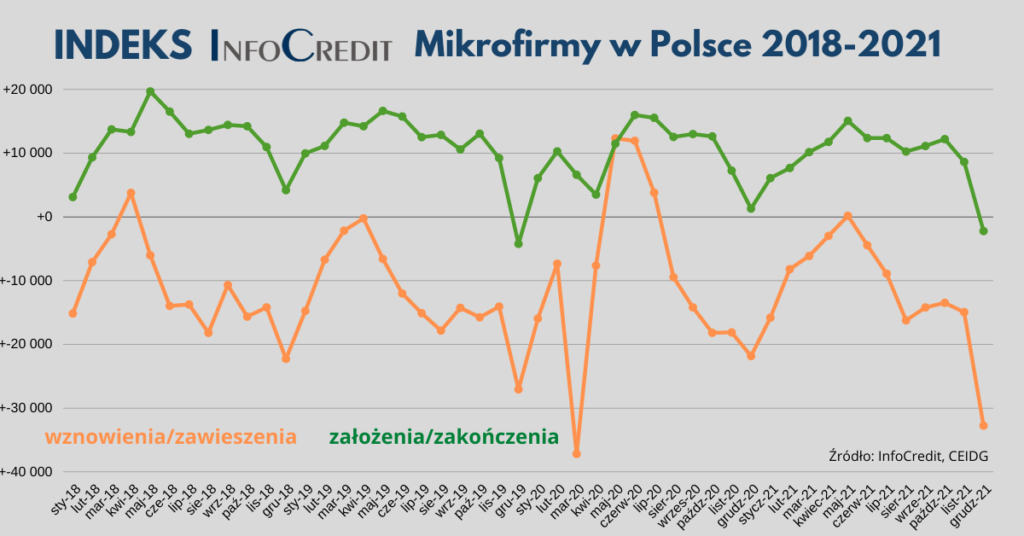

– The InfoCredit Business Activity Index, describing the ratio of new to terminated business activities, fell to its lowest level in two years in December 2021. The same was true for the indicator describing the ratio of resumed to suspended activities.

– In December 2021, there was a similar retreat from sole proprietorships as in March 2020, when entrepreneurs were terrified by restrictions due to the developing epidemic. One of the reasons was tax uncertainty.

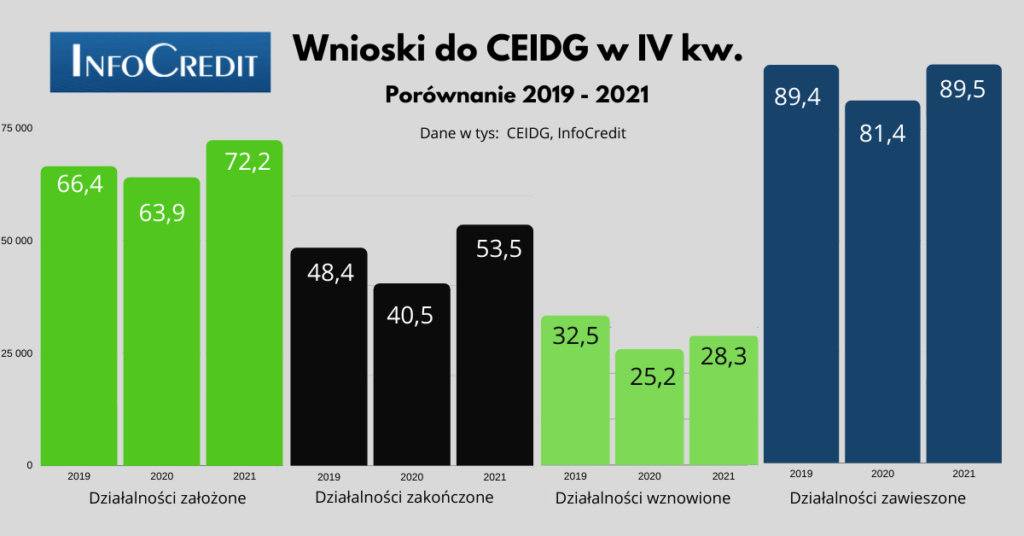

– In the entire fourth quarter of 2021, we also noted a significant increase in terminated and suspended activities. Although this is a seasonal phenomenon, in 2020 and 2019 these proportions were smaller.

– Last year is another, after 2020, in which we noted a decrease in the number of CEIDG applications below 900 thousand in total. There were 889 thousand of them (850 thousand a year earlier) compared to 950 thousand in 2019, over 970 thousand. in 2017-2018 and almost 1 million in 2015.

In December and throughout the fourth quarter of 2021, entrepreneurs who had concerns that the new regulations would significantly reduce the profitability of their businesses, went to CEIDG to submit applications to suspend and terminate their business. The result is a significant deepening of the downward trend of InfoCredit indices, which has been ongoing since May last year.

– The closer to the turn of the year, the greater doubts entrepreneurs have about the profitability of their own business. Especially those for whom every increase in contributions or charges matters in the final analysis. Let us recall, for example: for many larger businesses, the increase in health insurance contributions from several thousand in 2021 to the forecasted several hundred thousand is an insurmountable barrier. This has been visible since May, when the assumptions of the Polish Deal were presented. In our opinion, their decision was also significantly influenced by the rising costs of operations driven by the increase in inflation. There is also growing talk that such an uncertain economic, legal and tax situation may contribute to another significant increase in the size of the grey zone – says Jerzy Wonka, Development Director at InfoCredit.

The end of the year usually favors decisions to close or suspend a business. However, the past month was exceptional. 24.3 thousand businesses were established, 26.6 thousand were terminated, 9.1 thousand were resumed, and as many as 41.9 thousand were suspended. The retreat was most visible in the last decade of December – 15.9 thousand businesses were terminated and 27.2 thousand were suspended. It has not been this bad since the last decade of March 2020, when 28.4 thousand businesses were suspended and 3124 were terminated. – It is worth noting that in December 2021 there were significantly more terminations than in March 2020. At that time, entrepreneurs were holding off on decisions, waiting for the situation to develop. So they chose the state of suspension. Now many of them no longer have any doubts that the form of sole proprietorship, in the current conditions, has lost much of its attractiveness – adds Jerzy Wonka. More and more suspensions and terminations

Q4 2021 was the worst in three years in terms of applications for termination and suspension of business. In total, 53.5 thousand businesses were terminated and 89.5 thousand were suspended. In the same periods of previous years, the figures were 40.5 thousand and 81.4 thousand (2020) and 48.4 thousand and 89.4 thousand (2019), respectively.

The number of applications for termination and suspension of business activity increased from month to month, until the December peak in the last ten days of the month. In October and November, 23 thousand businesses were suspended, in December it was 41.9 thousand. The number of terminated businesses increased from 12.5 thousand in October to 14.6 thousand in November and to 26.6 thousand in December.

Much fewer applications than in 2015-2019

In the whole of 2021, there was a slight increase in applications to CEIDG compared to 2020, when the economy suddenly entered a deep recession. In total, there were 889,138 applications, renewals, terminations and suspensions compared to 849,518 in 2020. In previous years, traffic in CEIDG was much higher – 950,359 in 2019, 972,000 in 2018, 979,374 in 2017, and even almost a million in 2015. It is worth noting that in the whole of 2021, there were significantly fewer new and resumed businesses (436.3 thousand) than terminated and suspended businesses (453.9 thousand). This has already happened in previous years, but not in such proportions.

Rok | Założenie* | Zakończenie | Zawieszenie | Suma |

2021 | 436 318 | 175 911 | 277 954 | 890 183 |

2020 | 425 334 | 142 375 | 281 809 | 849 518 |

2019 | 470 184 | 173 320 | 306 854 | 950 358 |

2018 | 491 647 | 177 083 | 303 270 | 972 000 |

2017 | 491 234 | 178 898 | 309 242 | 979 374 |

2016 | 465 970 | 181 053 | 307 132 | 954 155 |

2015 | 476 948 | 192 987 | 311 854 | 981 789 |

Suma | 3 270 338 | 1 235 575 | 2 111 494 | 6 617 407 |

* It includes applications for starting and resuming a business. Source: CEIDG | ||||

How do we calculate the InfoCredit Index?

The InfoCredit Index was created to track trends in micro-entrepreneurship, alternative forms of employment and self-employment at a time when the situation on the labor market and in individual industries is changing dynamically. The index, which is developed by the oldest company in Poland analyzing the economy, takes on a positive value when there are more new businesses than closures. When there are fewer than closed businesses – a negative value. In the same way, we also track the ratio of resumed to suspended businesses.