January was a bit disappointing

JDG InfoCredit Index

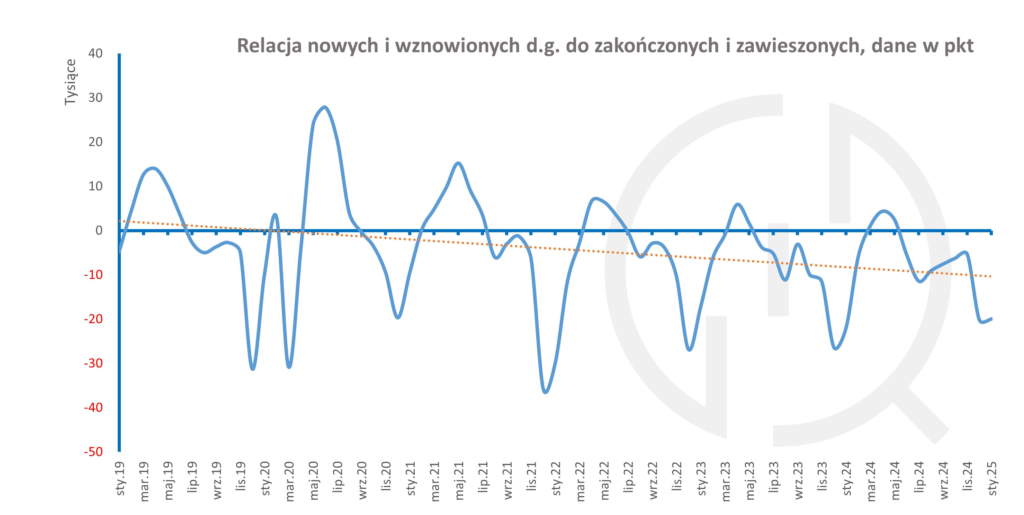

After a slight thaw in the last quarter of last year in sole proprietorships (SMEs), when the predominance of suspended and closed businesses over new and reopened businesses began to diminish, we expected a warmer January 2025. It was, but outside. The data showed a chill again.

In January, 58,595 businesses were suspended and closed. There were 38,632 new and reopened businesses. The InfoCredit index is therefore still well below zero at -19,963 points. January 2025 was similarly weak to last year (the index was then worth -21,967 points) and weaker than January 2023 (-17,202 points). Admittedly, it’s been worse. After the first month of 2022, our index reached its January low (-29,866 points). However, this was the first year of the Polish Deal and a mass retreat from business activity.

The end and beginning of the year always bring a seasonal preponderance of suspended and closed businesses over new and reopened ones. Our index hasn’t yet turned positive at the beginning of the year. However, there have been times when the data was much better than today, such as in 2019 and 2020 (-4,768 points and -9,870 points, respectively). But that was in the previous era – before the pandemic and everything that happened since.

There’s no breakthrough, then. Economic recovery is visible on the horizon. Forecasts for this year even call for GDP growth of up to 4%, compared to 2.9% last year, according to preliminary data. Funds from the National Operational Programme (KPO) are flowing for investments. So far, this hasn’t translated into a recovery in economic activity or the confidence of micro-entrepreneurs. Perhaps they need more evidence of an economic recovery? These are slowly trickling in. Earlier this week, we learned that consumers were more willing to spend their money in January – retail sales unexpectedly increased by 4.8% year-on-year. The automotive sector was most affected (+21.9%) and furniture, consumer electronics, and household appliances (+13.6%). Clothing saw growth of almost 9%.

What’s next? February (until February 21st) looks promising, better than in recent years. There’s a good chance the IC index will rise after February, from its current level of around -20,000 points to around -4,000. Perhaps we’ll even see a balance? Everything depends on the last week, as that’s when CEIDG typically sees the highest activity.