Survey: SpK about CIT

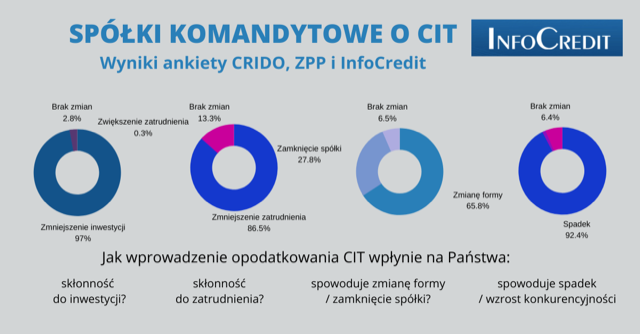

97% of surveyed entrepreneurs-co-owners of limited partnerships believe that CIT will reduce their willingness to invest.

86.5% claim that CIT will reduce their willingness to employ.

94.5% believe that as a result of the new tax, the competitiveness of limited partnerships will decrease.

65.75% are considering changing the form of business as a result of legal changes, and 27.75% are considering closing their business.

– according to a survey conducted in October by InfoCredit in cooperation with CRIDO and the Association of Entrepreneurs and Employers (ZPP).

Entrepreneurs and co-owners of limited partnerships unequivocally assessed the impact of introducing CIT on the future of their businesses. The survey results confirm the conclusions from the reports presented in October by CRIDO, ZPP and InfoCredit “SPK in Poland – data analysis” and “Taxation of limited partnerships in Europe”.

– The changes are most disturbing for Polish, small, family companies. They were the ones who clearly dominated the survey, responding most willingly and quickly. Over 87% of the completed surveys came from companies employing up to 49 people – says Jerzy Wonka, InfoCredit Development Director.

The vast majority of respondents, as much as 97%, believe that the tax will reduce their willingness to invest. Only 2.75% claim that it will have no effect, and 0.25% that investments will increase. 86.5% claim that CIT will reduce their willingness to employ (0.25% increase, 13.25% no effect). 94.5% believe that after the introduction of double taxation, the competitiveness of their companies will decrease (1.25% increase in competitiveness, 4.25% no effect).

Entrepreneurs believe that continuing to run their business as a limited partnership after the introduction of CIT ceases to be justified. As many as 65.75% are considering changing the form of business activity, and 27.75% are considering closing the company. Only 6.5% responded that CIT would not change anything.

– Contrary to the declarations of the Ministry of Finance, the survey results showed what had already resulted from the reports we had prepared earlier. The overwhelming majority of entrepreneurs, especially small ones, had a decidedly negative opinion of the idea of taxing limited partnerships with CIT. We can only hope that the Senate will hear the voice of Polish entrepreneurs and organizations representing them and, as a result, such bad regulations will not be passed. All the more so because this is happening at a time of creeping lockdown and many other problems that companies have to face. In such circumstances, discouraging entrepreneurs from fighting for their businesses is a very harmful action for the economy – comments Mateusz Stańczyk, partner in the tax advisory team at CRIDO.

– The survey results confirm our assumptions – taxing limited partnerships with CIT is a powerful blow to investment and employment. What’s more, it coincides with the crisis caused by the coronavirus epidemic, during which the willingness of entrepreneurs to invest has already fallen to a record low level. It is difficult to understand the legislator’s determination to push for this solution. It will not lead to a reduction in tax abuse, because it is not limited partnerships that are the problem in this respect – not only have we shown this in the reports published so far, but the Ministry of Finance itself has also admitted it. According to information provided by the ministry, the tax office has only challenged tax schemes using limited partnerships six times. One effect of this poor regulation may be to make it more difficult to emerge from the crisis caused by COVID-19 and to practically eliminate limited partnerships from the Polish economic landscape – says Jakub Bińkowski, director of the Department of Law and Legislation at the ZPP.

About the survey

The survey was conducted from 16 to 30 October in electronic form. We sent questions to limited partnerships registered in Poland and included in the InfoCredit database. We received 400 responses. The most active were micro and small businesses. 189 responses came from companies employing up to 9 people (47.25%), 160 from companies employing from 10 to 49 people (40%).