Microbusiness stagnation

InfoCredit Business Activity Index

-

In the second quarter of this year, there are no changes in economic activities: there is no point in talking about a revival.

-

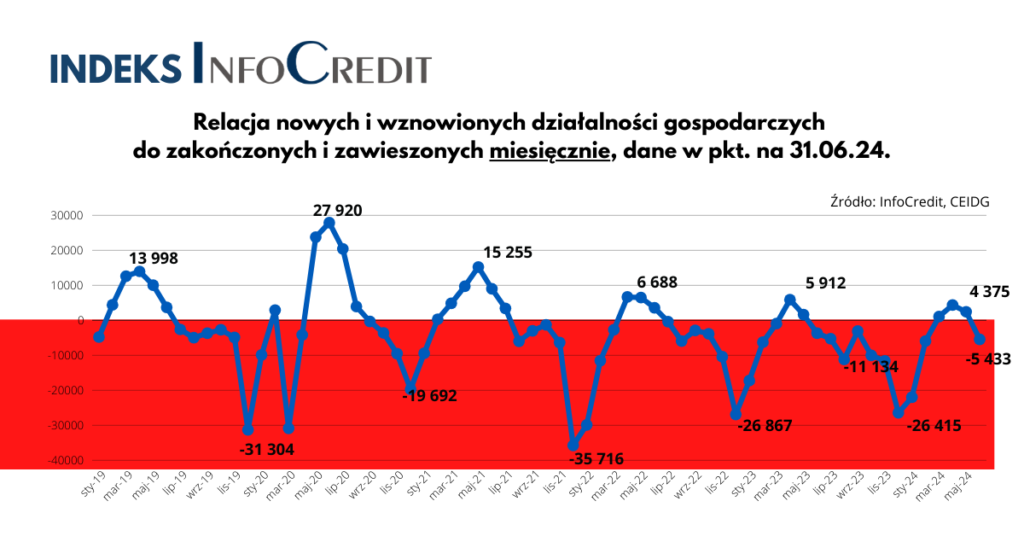

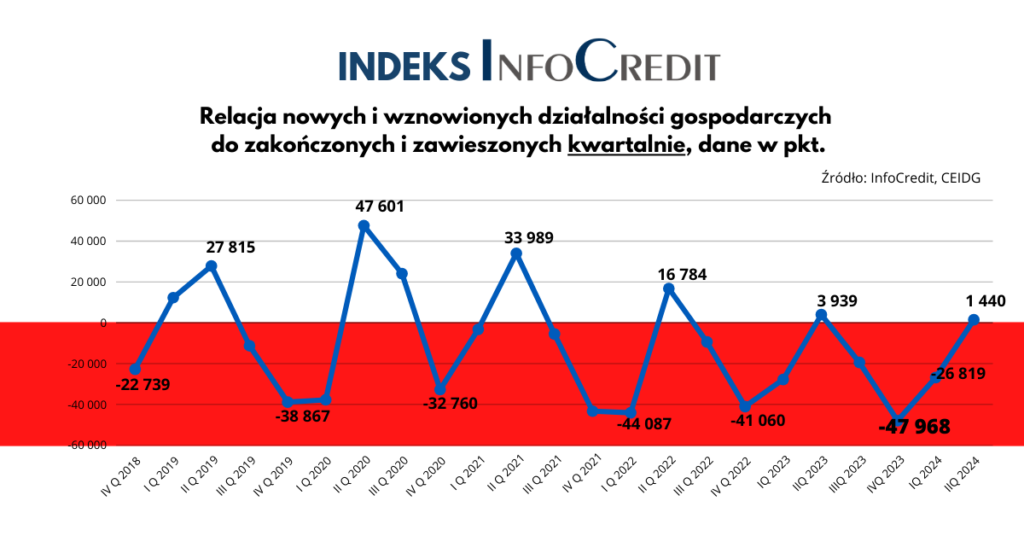

The InfoCredit micro-entrepreneurship index calculated quarterly after Q2 2024 has slightly turned positive, but it is much lower than a year ago. After a rather promising May, June brought us back down to earth.

-

In the last month of the second quarter, those closing and suspending economic activities once again had a big advantage. The index calculated monthly is in the red, lower than a year ago.

-

The InfoCredit indices continue to maintain cyclical fluctuations, but they are sinking lower and lower from year to year.

There are no changes in economic activities. We are still stuck in stagnation. In the second quarter of this year, 132.7 thousand economic activities were established and resumed (131.3 thousand were closed and suspended), which could be perceived positively. The InfoCredit index calculated quarterly therefore turned positive (+1440 points). The problem is that in the same period last year our index was worth +3889 points. And it is falling from year to year.

The second quarter has historically been usually good for opening and resuming business activities. We were making up for losses after a seasonally weaker end and beginning of the year. Two years ago, the InfoCredit index was worth +16,784 points, three years ago +33,989 points, and four years ago as much as +47,601 points. However, 2020 was a special year. After the collapse and panicky suspension in March 2020 (the beginning of the pandemic and the shock associated with restrictions), small businesses, especially tourist businesses, resumed their operations en masse before the holidays. After promising March, April and May, when new and resuming businesses had an advantage over those being closed and suspended, one could have hoped that the trend would reverse. However, June was a big disappointment. The InfoCredit index calculated monthly in the last month of the first half of the year plunged to -5433 points. It is much lower than a year ago (it was also weak then, but the index was worth -3648 points). And we have a similar situation as in quarterly terms. Two years ago, after June 2022, the index was worth +3,575 points, after H1 2021 it was +9,003 points, and after June 2020 even 27,920 points.

The graphs look very worrying. They maintain cyclical changes, but from year to year they sink lower and lower. Everything indicates that nothing will change this trend for now. Reliefs that were supposed to bring respite to small entrepreneurs (like holidays from ZUS) are still looming somewhere on the horizon).

By the way, we also tracked what happened in June in typically tourist communes. It happened. More on that soon.

How we calculate the InfoCredit business activity index

Our business activity index shows the ratio of new and resumed business activities to closed and suspended ones. When the index is positive, it means that more businesses were established and suspended than were suspended and closed. The higher the index value, the greater the tendency to open small businesses. When the index indicates values below zero, it means a retreat from this form of business activity. The more the index is negative, the more small entrepreneurs withdraw from business (definitely or temporarily). We publish the index on a quarterly basis (after each quarter) and monthly.